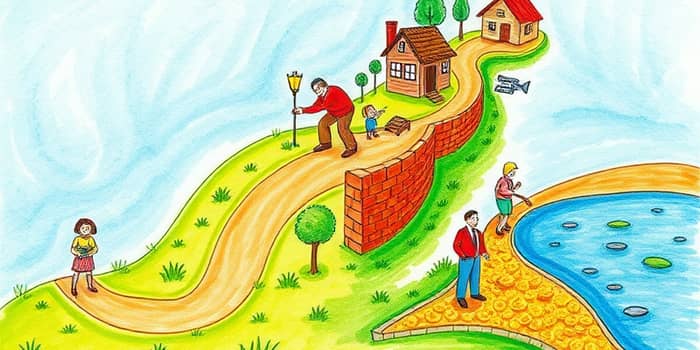

Investing isn’t one-size-fits-all; tailoring strategies to where you are in life can make all the difference.

Adapt investment strategies as circumstances evolve, aligning risk and reward with your current needs. Life-stage investing means shifting focus from aggressive growth in youth to capital preservation in later years.

By understanding each phase’s financial goals and responsibilities, you strengthen your foundation for the next chapter. This approach enhances flexibility and resilience in changing markets.

Financial priorities and risk tolerance naturally shift over time. Recognizing these shifts ensures your portfolio stays relevant to your goals.

With the longest time horizon, younger investors can embrace market volatility to build wealth. Historical data shows equities have outperformed bonds, averaging 7–10% annualized returns over decades.

Key strategies include:

Automating contributions to retirement and investment accounts cements disciplined saving and harnesses dollar cost averaging.

Financial responsibilities often spike—mortgage, children, and education planning take center stage. Adjusting priorities means balancing continued growth with added stability.

Rebalance portfolio in response to changes in obligations by gradually shifting toward fixed income and adding alternative assets if appropriate.

As retirement approaches, capital preservation becomes paramount. Reducing exposure to market shocks and sequence-of-returns risk safeguards your nest egg.

Strategies to consider include:

Estimate expected expenses in retirement and plan distributions accordingly to avoid surprises and ensure financial comfort.

The goal transforms to generating sustainable income while preserving principal. A common starting allocation might be 60% bonds and 40% dividend-paying equities.

Preserve capital during retirement transitions by holding sufficient cash reserves for at least one to two years of living expenses, cushioning against downturns.

Other essential actions:

• Begin Required Minimum Distributions (RMDs) at the mandated age (73–75 in the U.S.).

• Coordinate Social Security or pension income to optimize after-tax returns.

• Follow the 4% safe withdrawal guideline to minimize portfolio depletion risk over multi-decade retirements.

Several factors influence strategy adjustments across all stages:

Time horizon shortens and risk tolerance declines as you near retirement, making conservative allocations more appropriate. Specific goals like college funding or legacy planning require tailored sub-strategies.

Core principles remain consistent:

• Maintain a diversified portfolio across asset classes and geographies.

• Rebalance periodically to realign with target allocations.

• Automate contributions to reduce emotional bias and stay disciplined.

• Review your plan annually or after significant life events—marriage, childbirth, career changes—to ensure ongoing alignment.

Consider enlisting a qualified financial advisor for personalized guidance, especially when approaching retirement or managing complex estates.

Customizing investment plans by life stage builds a resilient, goal-oriented financial journey. By aligning asset allocation, savings rates, and risk exposure with your evolving needs, you create a robust framework for achieving milestones and safeguarding your future.

Periodically review and adapt your plan to ensure continued relevance, and enjoy the confidence that comes from a strategy thoughtfully tailored to every chapter of your life.

References