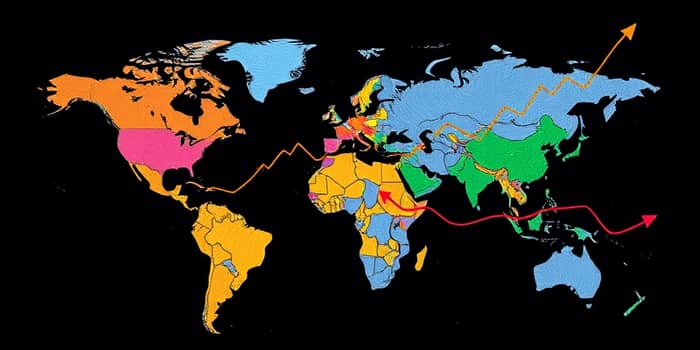

In 2025, global equity markets reflect a striking divergence driven by central banks charting very different monetary paths. Investors face a world where policy decisions in Washington, Frankfurt, Tokyo and Beijing shape capital flows, valuations and relative performance.

Understanding this complex interplay of policy shifts is essential for building resilient portfolios. As rate trajectories diverge, so do risks and opportunities across regions.

Major central banks begin the year with contrasting stances. The Federal Reserve holds rates high, considering modest cuts, while the European Central Bank moves to ease after a period of tightening. Japan embarks on a rare cycle of rate hikes, and China’s central bank stays cautious amid deflation risks.

This policy mosaic creates uneven disinflation progress and shapes capital costs, currency values and equity valuations across markets.

In the United States, equities benefit from robust US growth and labor markets. The S&P 500 is projected to reach 6,500, driven by strong AI spending, dealmaking and an estimated EPS of $270 for 2025. Technology and capital-expenditure sectors lead the way.

By contrast, the Eurozone faces headwinds from trade tensions, fiscal tightening and weaker demand. Sluggish growth and widening rate differentials weigh on EuroStoxx 50 performance, while the euro drifts toward parity with the dollar, partially easing export pressures.

Japan’s equity market shines amid corporate reforms, wage growth and robust domestic demand. The Bank of Japan’s modest tightening supports the yen and bolsters investor confidence, leading to capital buybacks and higher share valuations.

Emerging markets struggle under a strong US dollar and higher-for-longer global rates. External funding costs rise, pressuring equities in Asia, Eastern Europe and Latin America, although pockets of value emerge where local policies prove supportive.

Monetary divergence plays out through multiple channels, with exchange rates acting as shock absorbers and bond yields driving cross-border flows.

Moreover, environmental regulations and climate policies introduce new complexities, but these remain secondary to core monetary drivers in 2025.

Several factors could reshape the current narrative:

Understanding these uncertainties is vital for positioning portfolios to weather potential volatility and seize emerging opportunities.

By late 2025, markets may either deepen their divergence or begin to reconverge. If U.S. inflation trends sustainably lower and geopolitical risks ease, capital flows could rebalance toward Europe and emerging markets. Conversely, persistent policy gaps and external shocks would reinforce current trends.

Investors should monitor key indicators—rate differentials, inflation data, trade developments and central bank guidance—to anticipate shifts. Embracing dynamic portfolio allocation strategies and diversifying across themes such as technology, domestic consumption and decarbonization can help navigate this complex landscape.

Ultimately, the story of 2025 is one of regional policy contrasts shaping global equity outcomes. By staying informed and adaptable, investors can position themselves to thrive, whether markets diverge further or begin to move back toward equilibrium.

References